Homeowners Insurance in and around Arvada

Protect what's important from unplanned events.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

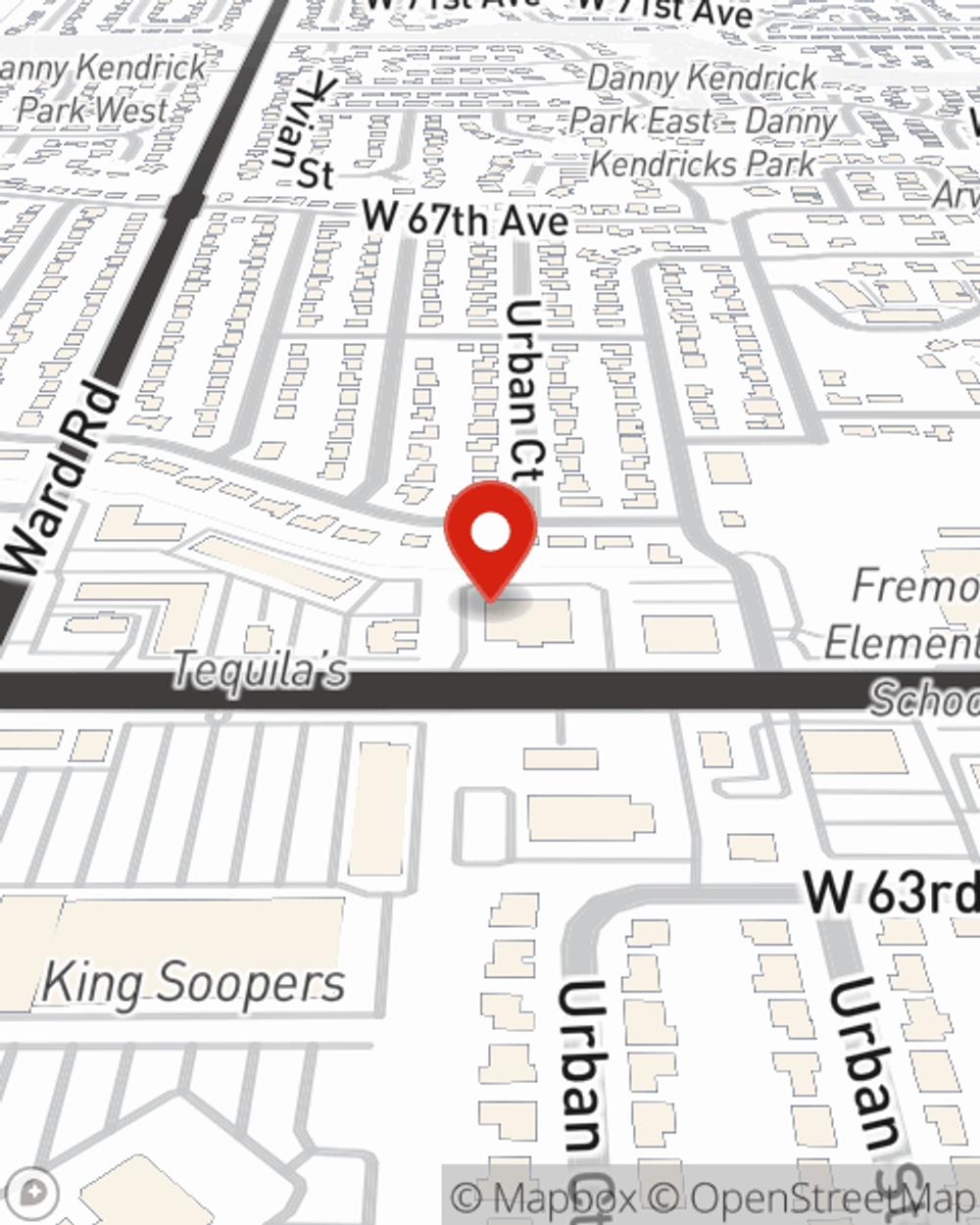

You have plenty of options when it comes to choosing a home insurance provider in Arvada. Sorting through deductibles and coverage options isn’t easy. But if you want competitive priced homeowners insurance, choose State Farm. Your friends and neighbors in Arvada enjoy unmatched value and straightforward service by working with State Farm Agent Kimberly Wood. That’s because Kimberly Wood can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as tools, mementos, appliances, cameras, and more!

Protect what's important from unplanned events.

Apply for homeowners insurance with State Farm

Protect Your Home Sweet Home

With this wonderful coverage, no wonder more homeowners select State Farm as their home insurance company over any other insurer. Agent Kimberly Wood would love to help you get the policy information you need, just reach out to them to get started.

So contact agent Kimberly Wood's team for more information on State Farm's exceptional options for protecting your home and keepsakes.

Have More Questions About Homeowners Insurance?

Call Kimberly at (303) 420-9384 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Kimberly Wood

State Farm® Insurance AgentSimple Insights®

Sauna benefits, types and safety tips

Sauna benefits, types and safety tips

A good steam bath is invigorating. Learn the benefits of saunas and the best way to use them with these simple but important safety tips.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.